Framingham Ltd. produces three products out of a common process. The company currently uses the physical measures method to allocate joint costs to the three product lines: Leonid (L), Madagascar, (M) and Napoleon (N). The manager of the Napoleon product line is particularly disgruntled. He believes that his product line is allocated a disproportionate share of joint costs. In a recent managers' meeting, he argued that the company should consider using sales value as split off as the joint cost allocation method. He stated that his product is sold in a highly competitive market and increasing price is not an option.

The manager of the Leonid product line disagreed strongly. He stated that all products are sold in a competitive market place and that allocating joint costs on physical measures was simple and easily verifiable. The manager of the Madagascar product line sat quietly through the meeting and she did not seem to favour one method over the other.

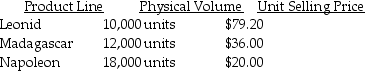

As the assistant controller, you were asked by the controller to look into the concerns of the product line managers. The following additional information is available:

Joint costs for the company are $950,000.

Joint costs for the company are $950,000.

Required:

As the assistant controller, prepare a report to the controller.

Definitions:

R&D Expenditures

Costs associated with the investigation and testing of new products or innovations.

FASB Justifications

Rationales and explanations provided by the Financial Accounting Standards Board for its accounting standards and practices.

Carrying Value

Also known as book value, it's the value of an asset or liability according to a company's balance sheet, factoring in depreciation and amortization.

Economic Benefits

The gains received by individuals or organizations from their economic activities.

Q4: Customer-specific costs are costs that are traceable

Q22: Marble Shop manufactures marble products. All direct

Q29: A composite unit is a hypothetical unit

Q48: The final result of the process costing

Q49: A major deficiency of the sales value

Q66: Which of the following illustrates a purpose

Q84: List and describe the procedures required in

Q124: Companies that only record the invoice price

Q126: Which method of allocating costs would be

Q127: Successful reengineering efforts generally involve changing the