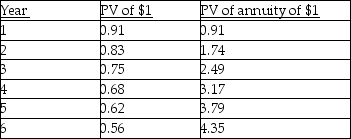

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-What is the annual expense deduction for CCA?

Definitions:

WBC Differential

A white blood cell count in which each type of white blood cell is classified and counted.

Oil Immersion Lens

A microscope lens that uses a drop of oil between the specimen and the lens to increase the resolution of the image by reducing light refraction.

Phagocytosis

A cellular process in which cells ingest and digest foreign particles, bacteria, or other substances.

Pyrogen

Capable of producing fever.

Q36: Which of the following would not prevent

Q44: When the vendor division receives full cost

Q55: Carrying costs arise when a customer demands

Q72: The required rate of return is<br>A) the

Q80: Costs incurred in detecting which of the

Q84: In job costing, costs of abnormal spoilage

Q107: Disc Company sells 400 discs per week.

Q113: During the current year, USACo (a domestic

Q115: What is the annual expense deduction for

Q151: Management has offered to allow the prevention