Use the information below to answer the following question(s) .

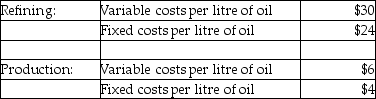

Blackoil Corp. has two divisions, Refining and Production. The company's primary product is Clean Oil. Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

-Division A sells soybean paste internally to Division B, which, in turn, produces soybean burgers that sell for $5 per kilogram. Division A incurs costs of $0.75 per kilogram, while Division B incurs additional costs of $2.50 per kilogram. Which of the following formulas correctly reflects the company's operating income per kilogram?

Definitions:

Stagnation

A period of lack of growth, development, or advancement, often reflected in middle adulthood when individuals may struggle with contributing meaningfully to society.

Erikson

A psychologist known for his theory on the psychosocial development of human beings, which outlines eight stages that individuals pass through from infancy to adulthood.

Midlife Crisis

A psychological crisis occurring in middle age characterized by emotional turmoil, identity questioning, and strong desires for change.

Levinson

Refers to the psychologist Daniel Levinson, known for his theory on human development, particularly the concept of life structures in adult development.

Q6: Measures which monitor critical performance variables that

Q7: If the appropriate tax rate is 35%,

Q19: Explain how the profitability index can be

Q40: Bob Cellular Phone uses ROI to measure

Q48: A project's net present value is increased

Q95: When a subsidiary sells to the parent

Q109: Capital budgeting emphasizes the role of financial

Q110: Dual pricing is widely used as it

Q115: What is the annual expense deduction for

Q130: ForCo, a foreign corporation not engaged in