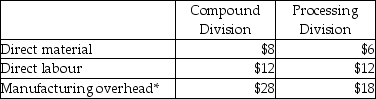

Payne Ltd. has two divisions. The Compound Division makes QZ54, an industrial compound, which is then transferred to the Processing Division. The Processing Division further processes the QZ54 and sells the final product to customers at $87/kg Capacity in the Compound Division is 800,000kg QZ54 can be obtained on the external market at $50/kg Data regarding the costs per kilogram in each division are presented below:

*In the Compound Division the variable overhead is 80% of the total, and in Processing variable overhead represents 65% of the total. Fixed overhead rates are based on capacity of 800,000kg in each division.

*In the Compound Division the variable overhead is 80% of the total, and in Processing variable overhead represents 65% of the total. Fixed overhead rates are based on capacity of 800,000kg in each division.

In addition to the manufacturing costs, the Compound Division would incur $2 per kilogram of selling costs which would be avoided on internal transfers. Similarly the Processing Division would avoid $3/kg of ordering costs on internal purchases.

Required:

a. Calculate the operating incomes for each division assuming 800,000kg of QZ54 are transferred and the company uses a market transfer price.

b. Calculate the operating incomes for each division assuming 800,000kg of QZ54 are transferred and the company uses a transfer pricing policy based on 125% of absorption manufacturing cost.

c. Comment on your calculations in a and b.

d. Should the company transfer its 800,000 kg assuming the Compound Division can sell all of its output on the external market?

Definitions:

Credentialed Public Accountant

A licensed accounting professional who has met certain education and experience requirements and passed a qualifying exam.

Professional Accountant

An individual who is certified to practice accounting and is held to a set of standards by a regulatory body.

Q28: A group's election to file consolidated Federal

Q37: Endicott Inc. has four divisions. Each division

Q42: The net present value method is better

Q45: Identify capital expenditures relevant to accomplishing strategic

Q46: Boundary systems describe standards of behaviour and

Q56: Return on investment is also called the

Q64: Kase Tractor Company allows its divisions to

Q103: Tex Corporation trades in a Class 10

Q132: Assume the transfer price for a compressor

Q144: ParentCo owned 100% of SubCo for the