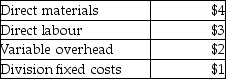

Answer the following question(s) using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.) The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

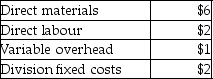

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

-What is the transfer price per pair of soles from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 180% of variable costs?

Definitions:

Gross Margin Percentage

The proportion of sales revenue remaining after deducting cost of goods sold, expressed as a percentage of sales revenue.

Net Operating Income

Income before interest and income taxes have been deducted.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including labor and materials.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity of the business.

Q7: If the appropriate tax rate is 35%,

Q20: What are the major relevant costs in

Q33: Berryton Products' only product has an annual

Q36: Wilf Company acquired an additional Class 10

Q56: During 2012, Martina, an NRA, receives interest

Q109: In computing consolidated taxable income, the purchase

Q113: Exertion towards a goal is<br>A) motivation.<br>B) effort.<br>C)

Q122: Given the following information, determine whether Greta,

Q134: In computing consolidated E & P, a

Q138: What is the market-based transfer price per