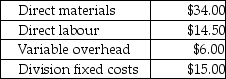

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

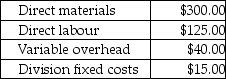

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the transfer price per compressor is 110% of full costs?

Definitions:

Daily Work-Related

Pertaining to the tasks, activities, and responsibilities that are part of an individual's routine job on a day-to-day basis.

Traditional Management

A leadership approach characterized by hierarchical organizational structures and clear, top-down directives focused on efficiency and control.

Sense of Alienation

A feeling of disconnection or estrangement individuals may experience within their workplace or society.

Greater Competitiveness

The enhanced ability of a company or country to compete more effectively and successfully in the marketplace.

Q11: Waldo, Inc., a U.S. corporation, owns 100%

Q22: What is the current-cost depreciation in year

Q26: Sandrington Ltd. operates a retail bicycle shop.

Q29: How many deliveries will be required at

Q44: The Columbian Coffee Company is planning on

Q55: Opportunity costs represent the cash flows directly

Q64: What is the transfer price per litre

Q92: The payback method discounts cash flows prior

Q95: Dolls "R" Us manufactures children's plastic dolls.

Q106: What are the total relevant inventory costs