Answer the following question(s) using the information below:

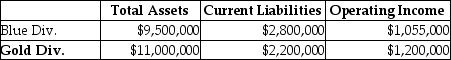

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Blue Division?

Definitions:

M&M Proposition II

A theory in corporate finance that asserts the cost of equity is a linear function of the company's debt/equity ratio, under the assumption of no taxes and financial distress costs.

Cost of Equity Capital

The return required by equity investors as compensation for their investment risk.

WACC

Weighted Average Cost of Capital, a measure of the average rate of return a company is expected to pay its securities holders to finance its assets.

Q15: The domestic production activities deduction of a

Q27: What tax accounting period is used by

Q33: A company's weighted-average cost of capital [WACC]

Q42: "Levers of control," in addition to a

Q93: Bedtime Bedding Ltd. manufactures pillows. The Cover

Q95: For a capital restructuring to qualify as

Q102: ParentCo's controlled group includes the following members.

Q108: Market-based transfer prices are ideal in perfectly

Q114: Ridge, Inc., a domestic corporation, reports worldwide

Q137: The group of Parent Corporation, SubOne, and