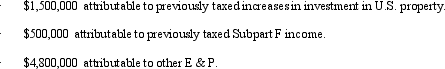

Steve, Inc., a U.S. shareholder owns 100% of a CFC from which Steve receives a $3 million cash distribution. The CFC's E & P is composed of the following amounts.  Steve recognizes a taxable dividend of:

Steve recognizes a taxable dividend of:

Definitions:

Consciousness of Kind

is the awareness or recognition of shared attributes or characteristics that create a sense of belonging within a group.

Shared Rituals

Practices or activities regularly performed in a group setting, fostering a sense of community and shared identity.

Moral Responsibility

The duty to act according to ethical principles, making choices that reflect a consideration for the welfare of others and the greater good.

Brand Community Strategies

Approaches employed by brands to engage and interact with their dedicated communities.

Q11: A company has total assets of $500,000,

Q21: Biermann Equipment is a publicly held corporation

Q41: Three years ago, Loon Corporation purchased 100%

Q59: In analyzing transfer prices<br>A) the buyer will

Q62: Interest paid to an unrelated party by

Q96: What is Economic Value Added (EVA) for

Q99: The Mill Flow Company has two divisions.

Q106: Team incentives encourage cooperation by<br>A) forcing people

Q115: Miller Medical Services provided the following information

Q136: All of the following criteria may be