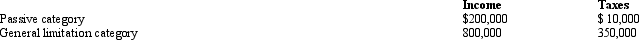

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Definitions:

Central Concepts

Foundational ideas or principles that are essential to understanding a particular field or topic.

Going to a Restaurant

The activity involving choosing, visiting, and eating at a restaurant, including the social and economic exchanges involved.

Agreement

A mutual understanding or arrangement between two or more parties.

Description Level

The degree of detail and specificity with which thoughts, observations, or phenomena are expressed or documented.

Q3: Miller Medical Services provided the following information

Q11: Canary Corporation has 1,000 shares of stock

Q46: Massey Corporation's nominal rate of return for

Q52: Ivory Corporation (E & P of $650,000)

Q88: Sensitivity analysis can be used to assess

Q88: Pheasant Corporation ended its first year of

Q99: Dividends received from a domestic corporation are

Q101: In 1916, the Supreme Court decided that

Q124: What is the transfer price per compressor

Q127: If a company is a multinational company