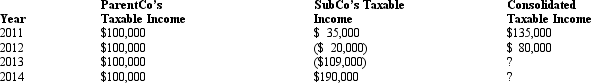

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2011. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  The 2013 consolidated loss:

The 2013 consolidated loss:

Definitions:

Unrealized Loss

A loss that results from holding onto an asset that has decreased in price, not realized until the asset is sold for a lower price.

Outstanding Voting Shares

The number of shares that are currently held by shareholders that grant them the right to vote on company matters.

Cash Dividend

Cash distributed by a business to its owners from the earnings it has generated.

Net Amount

The remaining balance of a transaction after all deductions, including taxes and discounts, have been applied.

Q28: In a § 351 transfer, the receipt

Q38: ParentCo's separate taxable income was $200,000, and

Q51: Which of the following persons typically is

Q59: Indigo has a basis of $1 million

Q59: Consolidated return members determine which affiliates will

Q71: A shareholder's basis in property received in

Q71: In certain circumstances, the amount of dividend

Q74: Purple Corporation has accumulated E & P

Q127: An affiliated group exists where there is

Q134: An advance pricing agreement (APA) is used