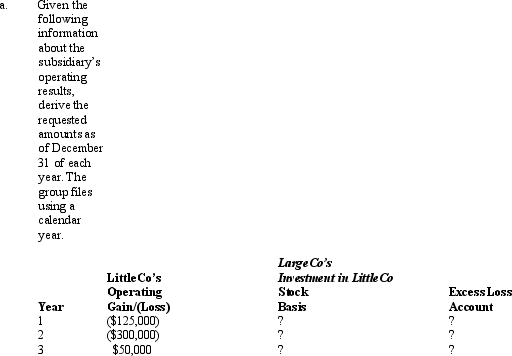

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, Year 1, and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

Definitions:

Affection

A feeling of fondness or liking, often expressed through physical or emotional closeness.

Carol Gilligan

An American feminist, ethicist, and psychologist best known for her work on ethical community and ethical relationships, and certain subject-object problems in ethics.

Kohlberg's Theory

A theory of moral development proposed by Lawrence Kohlberg, suggesting that people progress through a series of stages of moral reasoning.

Flawed

Having imperfections, defects, or shortcomings.

Q11: The acquiring corporation in a "Type G"

Q14: Ali is in the 35% tax bracket.

Q47: Tungsten Corporation, a calendar year cash basis

Q55: Hannah, Greta, and Winston own the stock

Q56: Eve transfers property (basis of $120,000 and

Q73: In June of the current year, Marigold

Q86: The tax treatment of the parties involved

Q120: With respect to income generated by non-U.S.

Q120: The executive vice president of Wicker Pen

Q134: What are Wheels's and Assembly's residual incomes