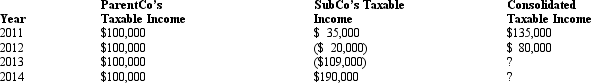

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2011. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  The 2013 consolidated loss:

The 2013 consolidated loss:

Definitions:

Trophic Level

The position an organism occupies in a food chain, categorized by the number of energy transfer steps from primary producers to top predators.

Habitat

Place where an organism lives and is able to survive and reproduce.

Per Capita Rate

A statistical measure that expresses the quantity of something per individual person within a population or area.

Spawn

The process by which many aquatic animals release or deposit eggs into water.

Q1: All of the following are appropriate methods

Q9: Federal income tax paid in the current

Q40: Bob Cellular Phone uses ROI to measure

Q58: What is the year 4 operating income

Q63: Unused foreign tax credits are carried back

Q66: When demand outstrips supply, market prices may

Q95: When a subsidiary sells to the parent

Q107: Liabilities are problematic only in the _

Q111: A product may be passed from one

Q131: KeenCo, a domestic corporation, is the sole