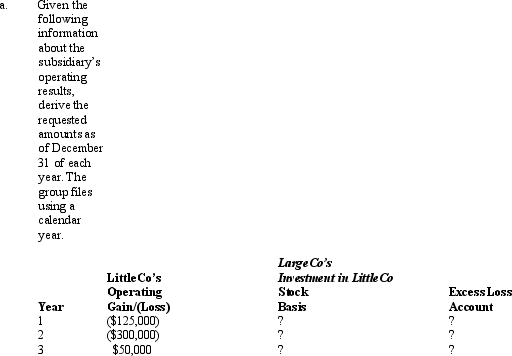

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, Year 1, and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

Definitions:

Angry Birds

A popular mobile game developed by Rovio Entertainment where players use a slingshot to launch birds at pigs stationed on or within various structures.

Bank of America

A multinational investment bank and financial services company headquartered in Charlotte, North Carolina, known as one of the largest banking institutions in the United States.

Social Media

Digital platforms that enable users to create and share content or participate in social networking, facilitating interaction among individuals and communities.

Traditional Print Media

Media consisting of paper and ink, distributed in physical form, such as newspapers, magazines, books, and pamphlets, as opposed to digital formats.

Q5: In which type of reorganization could bonds

Q5: The source of income received for the

Q14: Ali is in the 35% tax bracket.

Q20: On January 1, Gull Corporation (a calendar

Q42: NOLs are negative adjustments.

Q49: Constructive dividends have no effect on a

Q54: Discuss the treatment of accumulated earnings and

Q80: Consolidated estimated tax payments must begin for

Q108: On April 16, 2010, Blue Corporation purchased

Q131: ParentCo purchased 100% of SubCo's stock on