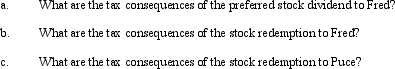

Fred is the sole shareholder of Puce Corporation, having a basis of $90,000 in 1,000 shares of Puce common stock. Last year, Puce (E & P of $500,000) issued a dividend of 2,000 shares of preferred stock to Fred. On the date of distribution, the fair market values per share of the common and preferred stocks were $160 and $20, respectively. In the current year, Puce (E & P of $720,000) redeems all of Fred's preferred stock for its fair market value of $40,000.

Definitions:

Income Statement

A financial report that shows a company's revenues, expenses, and profit over a particular period.

Retirement of a Bond

The repayment of the principal amount of a bond at or before its maturity date, effectively extinguishing the debt.

Other Comprehensive Income

Specified items that are reported separately from net income, including foreign currency items, pension liability adjustments, and unrealized gains and losses on investments.

Financial Statements

Reports that summarize the financial performance, position, and cash flows of a business over a specific period, typically including balance sheets, income statements, and cash flow statements.

Q2: The purpose of the deemed paid foreign

Q11: Donald owns a 60% interest in a

Q20: LargeCo files on a consolidated basis with

Q30: The continuity of business enterprise requires that

Q31: Rust Corporation has accumulated E & P

Q34: Lucinda owns 1,100 shares of Blackbird Corporation

Q35: Sam's gross estate includes stock in Tern

Q43: When a taxpayer transfers property subject to

Q47: RedCo, a domestic corporation, incorporates its foreign

Q60: Hawk Corporation has 2,000 shares of stock