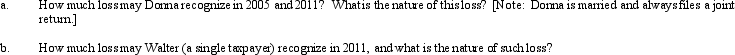

In 2004, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2005, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2011, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Definitions:

Median

A statistical measure representing the middle value in a data set, where half the numbers are above and half are below.

Absolute Zero

The lowest possible temperature where nothing could be colder and no heat energy remains in a substance, equivalent to -273.15°C or 0 Kelvin.

Nominal Data

A type of data that categorizes variables without a natural order or ranking among the categories.

Continuous Data

Data that can take any value within a given range, often representing measurements on a continuous scale.

Q6: Ocelot Corporation is merging into Tiger Corporation

Q14: The purpose of the rules governing intercompany

Q43: A corporate shareholder that receives a constructive

Q47: To help avoid the thin capitalization problem,

Q52: Which of the following has no effect

Q68: Canary Corporation, which sustained a $5,000 net

Q80: Fred is the sole shareholder of Puce

Q131: Tax professionals use the terms simple trust

Q139: In 2011, Valerie made a gift of

Q149: The Edgerton Estate generated distributable net income