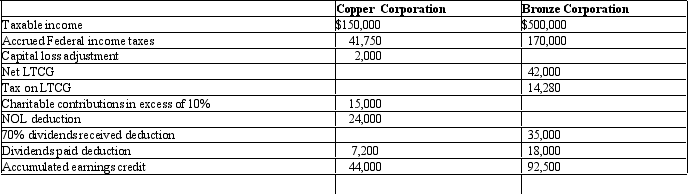

In each of the following independent situations, calculate accumulated taxable income, if any. Assume the corporation is not a mere holding or investment company.

Copper Corporation has $64,050 of accumulated taxable income and Bronze Corporation has $226,780 of accumulated taxable income:

Copper Corporation has $64,050 of accumulated taxable income and Bronze Corporation has $226,780 of accumulated taxable income:

Definitions:

Perfectly Inelastic

A market situation where the quantity demanded or supplied does not change in response to a change in price.

Elasticity of Demand

An indicator of the responsiveness of the quantity of a product demanded to its price alterations.

Total Revenue

The total income a firm receives from the sale of its products, calculated as the price per unit times the number of units sold.

Inelastic

A demand is considered inelastic when it does not significantly change with the price of a good or service, indicating that consumers are relatively insensitive to price changes.

Q4: Which of the following statements is true

Q12: Remainder beneficiary Shelley receives a $50,000 net

Q26: Ecru Corporation sells customized outdoor grills. The

Q62: A shareholder bought 2,000 shares of Zee

Q78: The LMN Trust is a simple trust

Q81: Pat, Maria, and Lynn are equal shareholders

Q84: When a corporation makes an installment sale,

Q96: A shareholder's holding period of property acquired

Q118: Mel's estate includes a number of notes

Q132: Bob and Paige are married and live