The LMN Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Kathie, Lynn, Mark, and Norelle) are entitled to the trust's annual accounting income in shares of one-fourth each. For the current calendar year, the trust has ordinary business income of $30,000, a long-term capital gain of $20,000 (allocable to income), and a trustee commission expense of $4,000 (allocable to corpus). Use the format of Figure 20.3 in the text to address the following items.

Definitions:

Abbreviation

A brief form of a word or phrase designed to conserve space or eliminate repetition.

Pet

A domestic or tamed animal kept for companionship or pleasure.

Meaning

The significance or understanding conveyed by words, signs, symbols, or actions.

Multiple Sclerosis

A chronic autoimmune disease affecting the central nervous system, leading to impairment of motor functions and other issues.

Q9: In determining the gift tax due on

Q38: The Yellow Trust incurred $10,000 of portfolio

Q40: The AMT exemption amount of $40,000 phases

Q56: Eve transfers property (basis of $120,000 and

Q101: Income is taxed to the creator of

Q121: At the time of his death, Jason

Q134: How is entity accounting income computed? What

Q142: Two brothers, Sam and Bob, acquire real

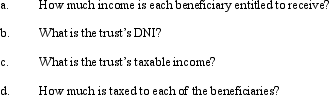

Q145: The LMN Trust is a simple trust

Q160: Don and Roxana are husband and wife