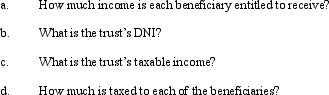

The LMN Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Kathie, Lynn, Mark, and Norelle) are entitled to the trust's annual accounting income in shares of one-fourth each. For the current calendar year, the trust has ordinary business income of $30,000, a long-term capital gain of $20,000 (allocable to corpus), and a trustee commission expense of $4,000 (allocable to corpus). Use the format of Figure 20.3 in the text to address the following items..

Definitions:

Safe Harbor

Legal provisions that protect parties from liability or penalties under specific conditions if they act in good faith.

Private Securities Litigation Reform Act

A 1995 U.S. law that aims to reduce frivolous or unnecessary securities lawsuits through various procedural and substantive changes.

Financial Forecasts

Projections of a company's future income, expenses, and capital requirements, based on assumptions about economic conditions, market trends, and business operations.

Affiliate

A business enterprise located in one state that is directly or indirectly owned and controlled by a company located in another state. Also called foreign subsidiary.

Q5: Cost and time are usually saved by

Q6: Under Circular 230, Burke cannot complete a

Q29: In each of the following independent situations,

Q33: If a parent corporation makes a §

Q50: Kim, a real estate dealer, and others

Q60: Tracy and Lance, equal shareholders in Macaw

Q68: Which, if any, of the following statements

Q79: If stock rights are taxable, the recipient

Q135: In determining the Federal gift tax on

Q137: The first step in computing an estate's