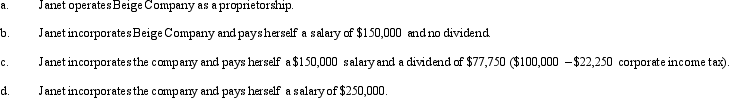

Beige Company has approximately $250,000 in net income in 2011 before deducting any compensation or other payment to its sole owner, Janet (who is single). Assume that Janet is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following arrangements. (Ignore any employment tax considerations.)

Definitions:

Economic Goods

Items or services that have a price and are scarce in relation to their demand, thus necessitating economic decision-making.

Scarce Resources

Raw materials, labor, and capital that are limited in availability, requiring societies to make decisions on their allocation and use.

Unit-Costs

Expenses a firm faces for producing, holding, and marketing one unit of a given product or service.

Restricts Trade

Actions or policies implemented by governments or economic entities to limit or control the exchange of goods and services across borders.

Q37: Osprey Company had a net loss of

Q39: If both §§ 357(b) and (c) apply

Q40: The AMT exemption amount of $40,000 phases

Q83: Grebe Corporation was formed in 2000. If

Q99: In 1990, Jude, a resident of New

Q103: Boasso Corporation manufactures an exercise machine at

Q108: Which entity is subject to the ACE

Q111: Eric dies at age 96 and is

Q113: During the current year, Lavender Corporation, a

Q154: Entity accounting income is controlled by the