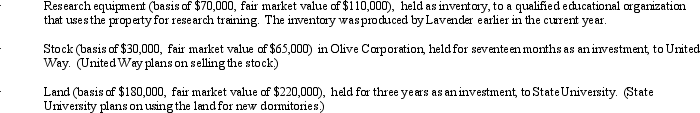

During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows:

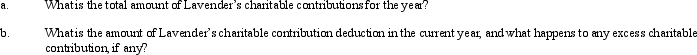

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Definitions:

Pollution Levels

The concentration of pollutants in the environment, affecting air, water, and soil quality.

Marginal External Cost

The cost of producing an additional unit of a good or service that is borne by individuals other than the producer, typically not reflected in the market price.

Park Visitation Fee

A charge imposed on visitors for access to a park, used to fund conservation efforts, maintenance, and improve the visitor experience.

National Parks

Protected areas of natural significance designated by national governments for conservation purposes, and for the enjoyment and recreation of the public.

Q20: Trudy forms Oak Corporation by transferring land

Q36: Under some circumstances, the sale of prepared

Q49: Briefly describe the charitable contribution deduction rules

Q50: If depreciable property is transferred by gift,

Q60: Kim, a resident and citizen of Korea,

Q89: The Roz Trust has distributable net income

Q103: Boasso Corporation manufactures an exercise machine at

Q119: A complex trust pays tax on the

Q121: At the time of his death, Jason

Q152: Andrea dies on April 30, 2011. Which,