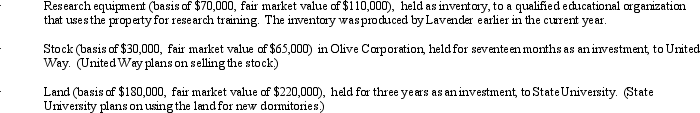

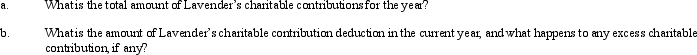

During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows:

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Definitions:

Heuristics

Mental shortcuts or rules of thumb that simplify decision making and problem-solving processes.

Algorithms

A set of instructions designed to perform a specific task or solve a particular problem.

Mental Sets

The framework of cognitive biases and predispositions to respond to a situation in a particular way, which can impact problem-solving abilities.

Fixation

An obsessive focus or attachment to someone or something that can result from unresolved developmental conflicts.

Q2: When a "prompt assessment" of the tax

Q13: Faye, a CPA, is preparing Judith's tax

Q22: If a corporation is thinly capitalized, all

Q51: An expense that is deducted in computing

Q63: Becky made taxable gifts in 1974, 2010,

Q75: Azul Corporation, a personal service corporation, had

Q84: In 2009, Sophia sold real estate (adjusted

Q105: Isaiah filed his Federal income tax return

Q130: The Gable Trust reports $20,000 business income

Q148: The taxpayer can avoid a valuation penalty