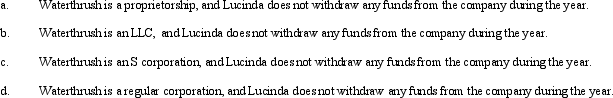

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Definitions:

Senator George McGovern

An American politician and historian who served as a United States Senator and was the Democratic presidential nominee in 1972.

Electoral System

The set of rules that determine how elections and referendums are conducted and how their results are determined, including mechanisms for voting and electing representatives.

Democratic Party

One of the two major contemporary political parties in the United States, historically associated with progressive social policies and a strong federal government.

Iranian Hostage Crisis

A diplomatic standoff between Iran and the United States where 52 American diplomats and citizens were held hostage for 444 days from November 4, 1979, to January 20, 1981.

Q6: Glenda is the sole shareholder of Condor

Q40: What is the rationale for the deferral

Q52: The Gibson Estate is responsible for the

Q76: At the time of Dylan's death, he

Q95: For both the Federal gift and estate

Q100: The first step in deriving the taxable

Q124: Under his grandfather's will, Tad is entitled

Q141: Does the tax preparer enjoy an "attorney-client

Q143: When one spouse predeceases the other, the

Q145: The LMN Trust is a simple trust