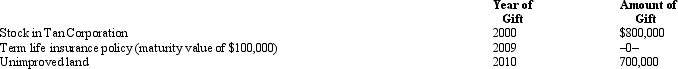

Prior to his death in 2011, Gordon made the following taxable gifts.

The policy of Gordon's life was given to the designated beneficiary. The gift of the stock and the land generated gift taxes of $28,750 and $64,250, respectively.

The policy of Gordon's life was given to the designated beneficiary. The gift of the stock and the land generated gift taxes of $28,750 and $64,250, respectively.

As to these transfers, how much is included in Gordon's gross estate?

Definitions:

Severable Contract

A contract whose terms can be divided.

Divisible

Capable of being divided or separated into smaller components or parts.

Pygmalion Effect

The phenomenon where higher expectations lead to an increase in performance; a form of self-fulfilling prophecy.

Perceptual Distortion

A cognitive bias or error that affects the accuracy of one's perception or interpretation of reality.

Q4: To reduce trustee commissions, the Sigrid Trust

Q22: Application of the blockage rule has been

Q31: The current $5 million exemption equivalent is

Q60: Almost all of the states assess some

Q71: Mickey, a calendar year taxpayer, was not

Q94: Harry and Brenda are husband and wife.

Q108: Which of the following statements is correct?<br>A)

Q117: In the context of civil tax fraud,

Q125: Stacey inherits unimproved land (fair market value

Q153: Shaker Corporation operates in two states, as