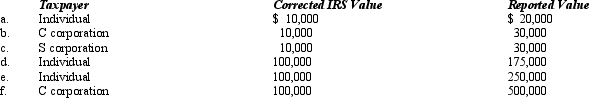

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property. In each case, assume a marginal income tax rate of 35%.

Definitions:

Uncollectible Accounts

Refers to receivables that are deemed unlikely to be collected, indicating potential losses for a company.

Allowance for Doubtful Accounts

An accounting provision made by a company to account for accounts receivable that might not be collected.

Bad Debts Expense

Financial accounting charge for accounts receivable that a company does not expect to collect.

Allowance Method

The Allowance Method is an accounting technique that estimates and accounts for potential uncollected receivables or bad debt expenses.

Q18: The _ tax usually is applied at

Q48: The current tax expense reported on the

Q57: Circular 230 allows a tax preparer to:<br>A)

Q74: An organization that is a for-profit entity

Q84: Define a private foundation.

Q104: A limited liability company (LLC) can elect

Q113: At the time of his death, Norton

Q113: Compute the overvaluation penalty for each of

Q124: Which of the following taxes that are

Q132: To file for a tax refund, an