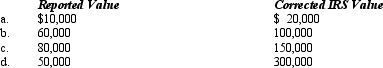

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate tax rate of 45%.

Definitions:

Likeability Scale

A measure used in social psychology to assess the extent to which a person is perceived as likable or pleasant by others.

Central Trait

A core characteristic of an individual that is considered pivotal in the formation of overall impressions by others.

Somewhat Lazy

Describes a mild lack of motivation or effort in completing tasks or engaging in activities.

Schema

A schema is a cognitive framework or concept that helps organize and interpret information, allowing individuals to understand and predict the world around them.

Q4: The privilege of confidentiality applies to a

Q9: In April 2010, Ed gives his mother,

Q49: In each of the following independent situations,

Q63: During 2011, Sparrow Corporation, a calendar year

Q72: Revenue generated by an exempt organization from

Q101: General Corporation is taxable in a number

Q109: A Federal gift tax return may have

Q112: Which of the following requirements are among

Q121: In a typical estate freeze involving family

Q143: In making gifts of property to family