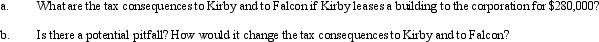

Kirby, the sole shareholder of Falcon, Inc., leases a building to the corporation. The taxable income of the corporation for 2011, before deducting the lease payments, is projected to be $300,000.

Definitions:

BSFT

Brief Strategic Family Therapy, a therapeutic approach designed to address problematic behaviors and relationships within families, particularly those affecting youth.

Scapegoat

An individual or group unfairly blamed for problems or negative outcomes that they did not cause.

Mascot

A character or symbol, often representing a group or organization, used for promotion or branding purposes.

Bowenian Theory

A theory of family therapy that emphasizes intergenerational transmission of emotional processes and working towards differentiation of self.

Q4: Determine the incorrect citation:<br>A) Ltr. Rul. 20012305.<br>B)

Q11: Martin has a basis in a partnership

Q17: Support the Child, Inc., a § 501(c)(3)

Q53: Usually a business chooses a location where

Q71: If the amounts are reasonable, salary payments

Q87: The § 1374 tax is a corporate-level

Q90: Which, if any, of the following items

Q103: An S corporation with substantial AEP has

Q105: A corporation can avoid the accumulated earnings

Q135: Parent and Junior form a unitary group