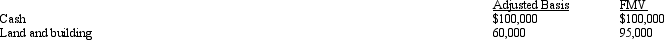

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

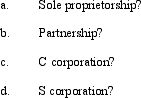

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

Definitions:

Shares Outstanding

The total number of shares of a company that have been issued and are currently owned by shareholders.

Market Value

The current price at which an asset or company can be bought or sold in the marketplace.

Net Present Value

The calculation used to determine the current value of a series of future cash flows, adjusted for time and interest.

Acquisition Cost

is the total cost incurred to acquire an asset, investment, or property, which includes the purchase price and all associated expenses.

Q29: Which type of distribution from an S

Q29: Bert Corporation, a calendar-year taxpayer, owns property

Q30: Aaron owns a 30% interest in a

Q41: Troy, an S corporation, is subject to

Q49: Which of the following taxes are included

Q62: Michelle receives a proportionate liquidating distribution when

Q85: An S shareholder's basis is increased by

Q93: To the extent of built-in gain or

Q100: Typically exempt from the sales/use tax base

Q131: Samantha owned 1,000 shares in Evita, Inc.,