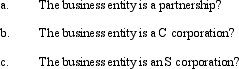

Gladys contributes land with an adjusted basis of $70,000 and a fair market value of $100,000 to a business entity in which she is an 80% owner on the first day of the tax year. Discuss the tax consequences to Gladys if the business entity sells the land six months later for $130,000 if:

Definitions:

Fetus

A stage in human development that starts from the ninth week after fertilization until birth, characterized by rapid growth and specialization of body structures.

Ancient Greeks

The people and culture of Greece during the classical period of antiquity, renowned for contributions to philosophy, art, politics, and science.

Stage Of Development

A phase in the growth or progression of something, often used in the context of psychological, physical, or social development.

Epigenome

The full set of factors, from DNA to outside world that controls the expression of coded genes.

Q8: An S shareholder's basis is decreased by

Q19: A former spouse is treated as being

Q29: Bailey's noncontrolling interest share for 2014 is<br>A)

Q41: How can double taxation be avoided or

Q50: The U.S. Federal government has a provision

Q65: BCD Partners reported the following items on

Q72: What are the characteristics of an S

Q73: Although apportionment formulas vary among jurisdictions, most

Q76: Gator, Inc., is a domestic corporation with

Q128: Meeting the definition of a small business