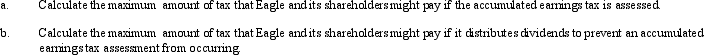

Eagle, Inc. recognizes that it may have an accumulated earnings tax problem. According to its calculation, Eagle anticipates it has accumulated taxable income, before reduction for dividends paid, of $600,000 in 2011. Assume that its shareholders are in the 35% marginal tax bracket.

Definitions:

Controlling Interest

Controlling interest is an ownership interest in a corporation that gives the shareholder sufficient voting power to influence or direct the company's management and policies.

Common Stock

Equity ownership in a corporation, representing a claim on its earnings and assets, and conferring voting rights in certain corporate decisions.

Cost Method

This accounting approach involves recording an investment at its original cost without adjusting for changes in market value.

Equity Method

An accounting technique used to record investments in other companies where the investor has significant influence but does not have full control.

Q13: What are the key components of tax

Q32: Temporary Regulations have the same authoritative value

Q57: An effective way for all C corporations

Q62: Several individuals acquire assets on behalf of

Q84: The MBA Partnership makes a § 736(b)

Q89: Individuals Adam and Bonnie form an S

Q110: Wonder, Inc., a § 501(c)(3) exempt organization,

Q121: An S corporation is entitled to a

Q139: Which statement is incorrect with respect to

Q144: An exempt organization can avoid classification as