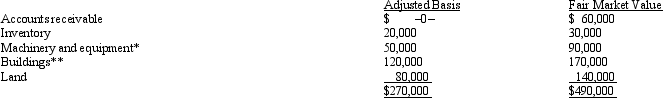

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Developing Country

A nation with a lower living standard, underdeveloped industrial base, and low Human Development Index relative to other countries.

Capital Imports

The purchase and importation of foreign capital goods and services, reflecting a country's investment in assets that promote economic growth.

Foreign Aid

Financial or non-financial assistance given from one country to another, often to support development or alleviate poverty.

Purchasing Power

The real value of money in terms of the quantity of goods or services that one unit of money can buy.

Q3: Amelia, Inc., is a domestic corporation with

Q30: Rose, Inc., a qualifying § 501(c)(3) organization,

Q36: The starting point in computing state taxable

Q41: A(n) _ alien cannot own stock in

Q68: The earned income tax credit is refundable.

Q73: The due date for both Form 990

Q86: Typical indicators of nexus include the presence

Q96: Kevin, Cody, and Greg contributed assets to

Q98: The _ tax levied by a state

Q121: Cruz Corporation owns manufacturing facilities in States