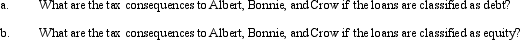

Albert and Bonnie each own 50% of the stock of Crow, Inc. (a C corporation). To cover what is perceived as temporary working capital needs, each shareholder loans Crow $150,000 with an annual interest rate of 5% (same as the Federal rate) and a maturity date of one year. The loan is made at the beginning of 2011.

Definitions:

Corpus Callosum

A thick band of nerve fibers that divides the cerebrum into left and right hemispheres, facilitating communication between the two sides of the brain.

Autism Spectrum Disorder

A range of neurodevelopmental conditions characterized by challenges with social skills, repetitive behaviors, and communication, with symptoms and severities that vary widely among individuals.

Myelination

The process of forming a myelin sheath around the nerves to increase the speed at which impulses propagate along the myelinated fiber.

Lateralization

The propensity for specific brain functions or mental processes to have a dominance in one side of the brain over the opposite side.

Q6: If lease rental payments to a noncorporate

Q10: A state wants to increase its income

Q17: Support the Child, Inc., a § 501(c)(3)

Q25: If these citations appeared after a trial

Q29: Bert Corporation, a calendar-year taxpayer, owns property

Q50: Jogg, Inc., earns book net income before

Q53: Do the § 465 at-risk rules apply

Q107: In calculating the owner's initial basis for

Q121: An S corporation is entitled to a

Q125: Wally contributes land (adjusted basis of $30,000;