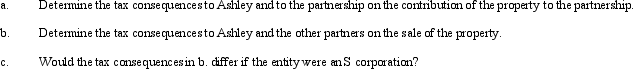

Ashley contributes property to the TCA Partnership which was formed 7 years ago by Clark and Tara. Ashley's basis for the property is $70,000 and the fair market value is $150,000. Ashley receives a 25% interest for his contribution. Because the TCA Partnership is unsuccessful in having the property rezoned from agricultural to commercial, it sells the property 12 months later for $210,000.

Definitions:

Adolescence

The transitional stage of physical and psychological development between childhood and adulthood.

Baby Boomers

The demographic cohort following World War II, typically referring to individuals born between 1946 and 1964.

Early Adulthood

A developmental stage typically ranging from the late teens through the twenties, during which individuals gain independence and explore various life paths.

Later Adulthood

A phase of life that follows middle age, where individuals often experience retirement and deal with aging-related issues.

Q1: Grant, a multinational corporation based in the

Q3: At the beginning of the tax year,

Q14: The excise tax that is imposed on

Q23: Bunker, Inc., is a domestic corporation. It

Q81: Barb and Chuck each have a 50%

Q96: Give an example of the indicated types

Q110: In most states, Federal S corporations must

Q127: Which requirements must be satisfied for an

Q129: José Corporation realized $600,000 taxable income from

Q133: _ is a means by which a