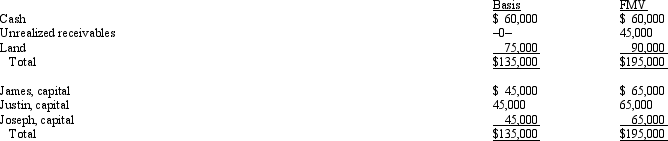

James, Justin, and Joseph are equal partners in the JJJ Partnership. The partnership balance sheet reads as follows on December 31 of the current year:  Partner Joseph has an adjusted basis of $45,000 for his partnership interest. If Joseph sells his entire partnership interest to new partner Kayla for $65,000 cash, how much capital gain and ordinary income must Joseph recognize from the sale?

Partner Joseph has an adjusted basis of $45,000 for his partnership interest. If Joseph sells his entire partnership interest to new partner Kayla for $65,000 cash, how much capital gain and ordinary income must Joseph recognize from the sale?

Definitions:

Specify Exceptions

Defining cases or conditions that do not follow the general rules within a system's operations.

Messages Received

Communications delivered to and stored in an inbox, such as emails, SMS, or app notifications.

Quick Part

A feature in some applications that allows users to insert preformatted text, documents parts, or media with a few clicks.

Reuse

The practice of using existing resources or components in new ways or in new contexts to save time, reduce costs, or leverage functionality.

Q4: What is Goldberg's percentage ownership in Savannah

Q19: Padhy Corporation owns 80% of Abrams Corporation,

Q27: Amber, Inc., has taxable income of $212,000.

Q35: Barb and Chuck each own one-half of

Q53: Crystal contributes land to the newly formed

Q71: Ashley purchased her partnership interest from Lindsey

Q73: Federal tax legislation generally originates in the

Q98: On January 2, 2010, David loans his

Q115: Which item has no effect on an

Q150: During 2011, Oxen Corporation incurs the following