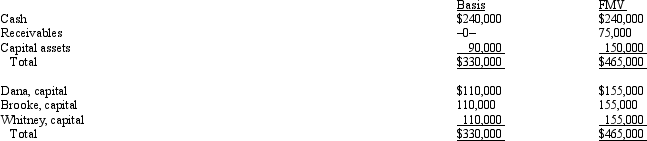

The December 31, 2011, balance sheet of the DBW General Partnership is as follows:

The partners share equally in partnership capital, income, gain, loss, deduction, and credit and capital is not a material income-producing factor. On December 31, 2011, general partner Dana receives a distribution of $155,000 cash in liquidation of her interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $110,000. What is Dana's gain or loss on the distribution and its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit and capital is not a material income-producing factor. On December 31, 2011, general partner Dana receives a distribution of $155,000 cash in liquidation of her interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $110,000. What is Dana's gain or loss on the distribution and its character?

Definitions:

Individual's Value

The worth or significance of a person, often considered in terms of their qualities, actions, and contributions to society.

Willing

Displaying a readiness or preference towards a particular action or decision.

Consumer Surplus

See Buyer Surplus.

Maximum Price

The highest price that can be charged for a good or service, often set by regulatory authorities to protect consumers.

Q9: Pancake Corporation saw the potential for vertical

Q19: If the bonds were originally issued at

Q34: Generally, gain is recognized on a proportionate

Q41: How can double taxation be avoided or

Q61: How are deferred tax liabilities and assets

Q76: Which exempt organizations can file a Form

Q79: Your client has operated a sole proprietorship

Q80: Which of the following taxes are included

Q95: Michelle and Jacob formed the MJ Partnership.

Q126: Compare the distribution of property rules for