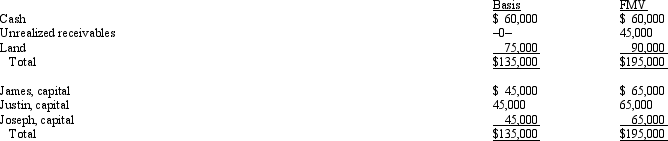

James, Justin, and Joseph are equal partners in the JJJ Partnership. The partnership balance sheet reads as follows on December 31 of the current year:  Partner Joseph has an adjusted basis of $45,000 for his partnership interest. If Joseph sells his entire partnership interest to new partner Kayla for $65,000 cash, how much capital gain and ordinary income must Joseph recognize from the sale?

Partner Joseph has an adjusted basis of $45,000 for his partnership interest. If Joseph sells his entire partnership interest to new partner Kayla for $65,000 cash, how much capital gain and ordinary income must Joseph recognize from the sale?

Definitions:

Writing

The act, process, or practice of recording thoughts, ideas, or information by inscribing symbols or characters on a surface.

Absence

The state of being away from a place or person, or the neglect to perform a duty or requirement.

Invoice

A document issued by a seller to a buyer listing the goods or services provided, their prices, and the total amount due.

Enforceable

A legal term denoting that an agreement or contract is legally binding and can be upheld in court.

Q1: With respect to the bond purchase, the

Q19: Parakeet Company has the following information collected

Q22: Controlling interest share of consolidated net income

Q31: Pfeifer Corporation acquired an 80% interest in

Q52: Lee owns all the stock of Vireo,

Q58: Amelia, Inc., is a domestic corporation with

Q68: One of the disadvantages of the partnership

Q76: Which exempt organizations can file a Form

Q78: A distribution from OAA is taxable.

Q96: Kevin, Cody, and Greg contributed assets to