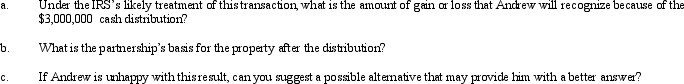

Andrew contributes property with a fair market value of $6,000,000 and an adjusted basis of $2,000,000 to AP Partnership. Andrew shares in $3,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $5,000,000. One month after the contribution, Andrew receives a cash distribution from the partnership of $3,000,000. Andrew would not have contributed the property if the partnership had not contractually obligated itself to make the distribution. Assume Andrew's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Marrying Later

The trend of individuals choosing to enter into marriage at older ages compared to historical norms.

Egalitarian Marriage

A type of marriage based on the principle of equality between partners, with shared decision-making and responsibilities.

Egalitarian Marriage

A marriage based on the principle of equal rights, responsibilities, and opportunities for spouses.

Traditional Marriage

A legally recognized union between two individuals in a personal relationship, historically based on societal norms and customs.

Q3: Plum Corporation paid $700,000 for a 40%

Q5: When preparing the consolidation workpaper for a

Q9: Molly is a 40% partner in the

Q20: In the current year, the CAR Partnership

Q23: Record the following transactions for Porter Hospital,

Q47: Yates Corporation elects S status, effective for

Q71: Ashley purchased her partnership interest from Lindsey

Q87: The § 1374 tax is a corporate-level

Q95: Albert and Bonnie each own 50% of

Q136: Janet Wang is a 50% owner of