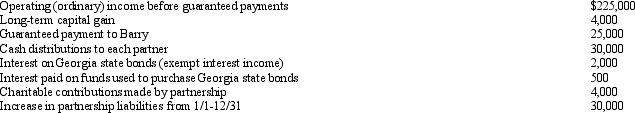

An examination of the RB Partnership's tax books provides the following information for the current year:

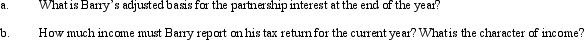

Barry is a 30% partner in partnership capital, profits, and losses. Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year, and he shares in 30% of the partnership liabilities for basis purposes.

Barry is a 30% partner in partnership capital, profits, and losses. Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year, and he shares in 30% of the partnership liabilities for basis purposes.

Definitions:

Refracted

Refracted refers to the change in direction of a wave, such as light or sound, as it passes from one medium to another at an angle.

Reflected

The return of light, heat, sound, or energy from a surface.

Seismic Reflection Survey

A geophysical method for exploring Earth's subsurface by sending seismic waves and analyzing the reflected signals from subsurface structures.

Magnetic Survey

A geophysical method for mapping variations in the Earth's magnetic field, often used in mineral exploration.

Q8: The 2014 consolidated income statement showed noncontrolling

Q14: The 2014 unrealized gain from the intercompany

Q14: On December 31, 2013, Potter Corporation has

Q15: Prey Corporation created a wholly owned subsidiary,

Q28: Why are S corporations not subject to

Q33: Southtown Community Hospital (SCH) shows the following

Q38: In the consolidated income statement of Wattlebird

Q78: Melba contributes land (basis of $190,000; fair

Q113: Obtaining a deduction on payments made by

Q133: Since loss property receives a _ in