Use the following information to answer the question(s) below.

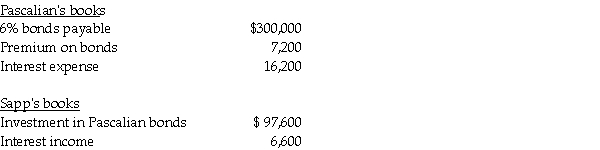

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2013,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2017.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2013.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2013,the books of the two affiliates held the following balances:

-Prussia Corporation owns 80% the voting stock of Stad Corporation.On January 1,2013,Prussia paid $391,000 cash for $400,000 par of Stad's 10% $1,000,000 par value outstanding bonds,due on April 1,2018.Stad's bonds had a book value of $1,045,000 on January 1,2013.Straight-line amortization is used.The gain or loss on the constructive retirement of $400,000 of Stad bonds on January 1,2013 was reported in the 2013 consolidated income statement in the amount of

Definitions:

Venn Diagram

A graphical representation using circles to illustrate the relationships among various sets or groups by showing where they overlap and differ.

Particular Proposition

A categorical proposition that makes an assertion about at least one but not all members of the class designated by its subject term (I and O).

Venn Diagram

A visual representation of the mathematical or logical relationships between different groups, often depicted with circles that overlap.

Existential Import

An attribute of propositions that implies the existence of the subject matter within logical or philosophical analysis.

Q1: A trust fund was created to assist

Q2: What is the document prepared by the

Q16: Durer Inc. acquired Sea Corporation in a

Q17: Bidden, Inc., a calendar year S corporation,

Q23: Jeremy sold his 40% interest in the

Q24: Pamula Corporation paid $279,000 for 90% of

Q25: On January 1, 2014, Palling Corporation purchased

Q41: Jamie owns a 40% interest in the

Q84: Which of the following is not a

Q89: Individuals Adam and Bonnie form an S