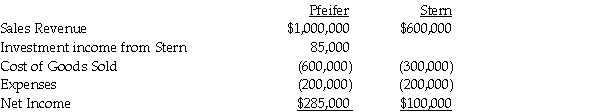

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal. At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets. Separate company income statements for Pfeifer and Stern for the year ended December 31, 2014 are summarized as follows:

During 2013, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2013. During 2014, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2014 inventory.

During 2013, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2013. During 2014, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2014 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2014.

Definitions:

Increased Value

The appreciation or rise in the worth of an asset or investment over a period of time.

Variance

A measure of the spread between numbers in a data set, indicating how much the numbers differ from the mean.

Arithmetic Average

A statistical measure of central tendency calculated by summing a set of values and dividing by the number of values in the set.

Geometric Average

A method of calculating the average rate of return that accounts for compounding, commonly used for investment portfolios.

Q10: For each of the following events or

Q19: A subsidiary can be excluded from consolidation

Q24: On January 1, 2014, Bigg Corporation sold

Q29: In a not-for-profit, private university, the federal

Q30: Controlling interest share of consolidated net income

Q36: Melissa is a partner in a continuing

Q37: Mason Dixon dies on November 30, 2014,

Q56: In a courtroom challenge, the burden of

Q64: The governing document of a limited liability

Q65: James, Justin, and Joseph are equal partners