Use the following information to answer the question(s) below.

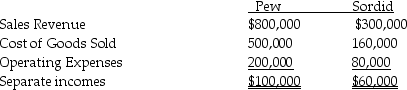

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

-The 2014 consolidated income statement showed cost of goods sold of

Definitions:

Net Income

The ultimate earnings a company reports after all deductions, including taxes and expenses, from total income.

Average Common Stockholders' Equity

The average equity held by common shareholders, calculated typically over a year, representing the company's assets minus its liabilities attributable to common shareholders.

Prior Period Adjustment

Adjustments made to the financial statements of a prior period to correct errors or implement changes in accounting policy.

Retained Earnings Account

An equity account on the balance sheet that represents the accumulated net earnings not distributed to shareholders in the form of dividends.

Q7: Panda Corporation purchased 100,000 previously unissued shares

Q10: Which of the following procedures is acceptable

Q19: Tye, Ula, Val, and Watt are partners

Q19: In reference to estate principal and income,

Q23: On January 2, 2014, Pal Corporation sold

Q23: In the business combination of Polka and

Q23: What is the proper disposition of a

Q36: A partnership cannot use the cash method

Q45: Which of the following indicates that a

Q134: How may an S corporation manage its