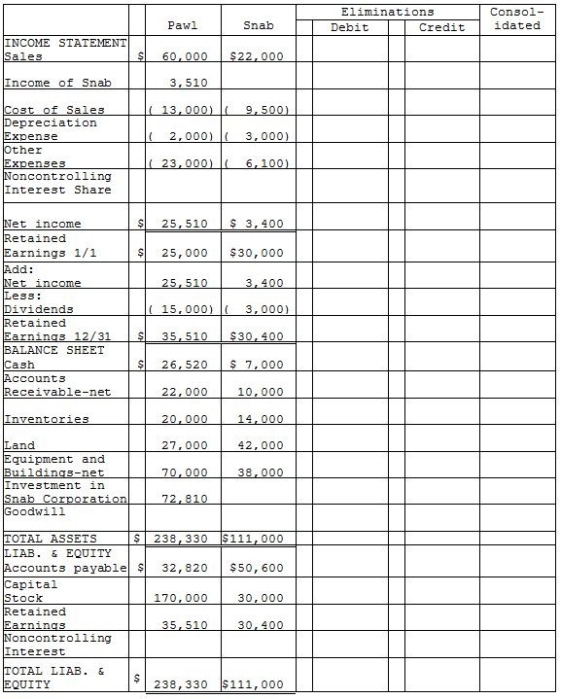

Pawl Corporation acquired 90% of Snab Corporation on January 1, 2014 for $72,000 cash when Snab's stockholders' equity consisted of $30,000 of Capital Stock and $30,000 of Retained Earnings. The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000. The remainder was attributable to goodwill. The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2014.

Definitions:

Net Present Value

A financial metric that calculates the present value of all cash flows, both incoming and outgoing, of an investment.

Managers

People in charge of managing or overseeing any or all parts of a corporation or comparable entity.

Firm Value

The total value of a company, determined by its earnings potential and the market's perception of its future growth prospects.

Q3: A newly acquired subsidiary had pre-existing goodwill

Q12: On January 1, 2013, Starling Corporation held

Q14: Under GAAP, for nonprofit, nongovernmental entities, an

Q14: On December 31, 2013, Potter Corporation has

Q21: Leotronix Corporation estimates its income by calendar

Q25: If these citations appeared after a trial

Q30: Aaron owns a 30% interest in a

Q32: Beth sells her 25% partnership interest to

Q35: A primary difference between voluntary and involuntary

Q76: In a proportionate nonliquidating distribution of cash