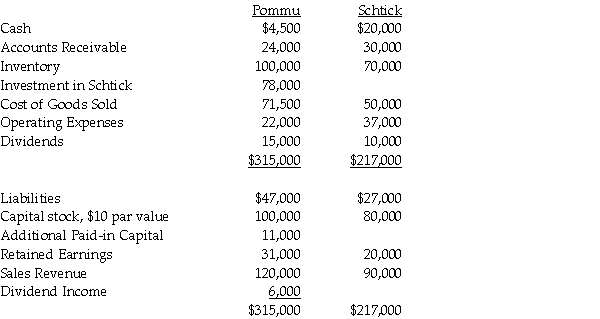

Pommu Corporation paid $78,000 for a 60% interest in Schtick Inc. on January 1, 2014, when Schtick's Capital Stock was $80,000 and its Retained Earnings $20,000. The fair values of Schtick's identifiable assets and liabilities were the same as the recorded book values on the acquisition date. Trial balances at the end of the year on December 31, 2014 are given below:

During 2014, Pommu made only two journal entries with respect to its investment in Schtick. On January 1, 2014, it debited the Investment in Schtick account for $78,000 and on November 1, 2014, it credited Dividend Income for $6,000.

During 2014, Pommu made only two journal entries with respect to its investment in Schtick. On January 1, 2014, it debited the Investment in Schtick account for $78,000 and on November 1, 2014, it credited Dividend Income for $6,000.

Required:

1. Prepare a consolidated income statement and a statement of retained earnings for Pommu and Subsidiary for the year ended December 31, 2014.

2. Prepare a consolidated balance sheet for Pommu and Subsidiary as of December 31, 2014.

Definitions:

Prescription Drugs

Medications that legally require a medical prescription to be dispensed, used for diagnosing, treating, or preventing disease.

Monitoring The Future

An ongoing study that surveys the behaviors, attitudes, and values of American secondary school students, college students, and young adults.

Life-Course-Persistent Offender

A person whose criminal activity typically begins in early adolescence and continues throughout life; a career criminal.

Adolescence-Limited Offender

A person whose criminal activity stops by age 21.

Q14: In partnership liquidation, how are partner salary

Q20: Jacana Corporation paid $200,000 for a 25%

Q22: On January 2, 2013, Slurg Corporation paid

Q24: On January 1, 2014, Singh Company acquired

Q26: In reference to the FASB disclosure requirements

Q28: For nonprofit, nongovernmental organizations, unconditional promises to

Q33: Sadie Corporation's stockholders' equity at December 31,

Q68: Rex and Scott operate a law practice

Q70: Allowing a taxpayer to choose either a

Q77: The RST Partnership makes a proportionate distribution