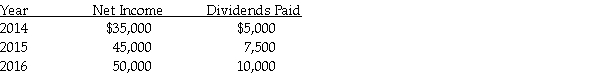

On January 1, 2014, Persona Company acquired 80% of Sule Tooling for $332,000. At that time, Sule reported their Common stock at $150,000, Additional paid in capital at $45,000, and Retained earnings at $105,000. Sule also had equipment on their books that had a remaining life of 10 years and were undervalued on the books by $40,000, but any additional fair value/book value differential is assumed to be goodwill. During the next three years, Sule reported the following:

Required: Calculate the following.

Required: Calculate the following.

a. How much excess depreciation or amortization would be recognized in the consolidated financial statements in each of these three years?

b. How much goodwill would be recognized on the balance sheet at the date of acquisition, and at the end of each year listed?

c. How much investment income would be reported by Persona under the equity method for each of the three years?

d. What would be the balance in the Investment in Sule account at January 1, 2014, and at the end of each of the three years listed?

Definitions:

Myelin Sheath

A fatty layer that encases the axons of some nerve cells, facilitating the rapid transmission of nerve impulses.

Axon

A long, narrow outgrowth of a neuron’s cell body that lets the neuron transmit information to other neurons.

Acetylcholine

A neurotransmitter in both the central and peripheral nervous systems involved in muscle activation and memory among other functions.

Antagonist

A substance that blocks or inhibits the effect of a neurotransmitter or hormone, or a character in conflict with the protagonist in literature.

Q2: Using the original information, the balances for

Q3: Which citation refers to a U.S. Tax

Q8: A technical advice memorandum is issued by:<br>A)

Q18: Required:<br>1. Prepare a schedule to allocate income

Q19: Pew Corporation (a U.S. corporation) acquired all

Q25: On January 1, 2014, Peabody Corporation acquired

Q34: Anna and Bess share partnership profits and

Q34: Which of the following statements is correct

Q36: Oscar Lloyd is the trustee for the

Q55: Matt receives a proportionate nonliquidating distribution. At