Use the following information to answer the question(s) below.

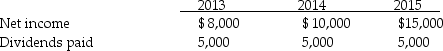

On January 1, 2013, Pansy Company acquired a 10% interest in Sunflower Corporation for $80,000 when Sunflower's stockholders' equity consisted of $400,000 capital stock and $100,000 retained earnings. Book values of Sunflower's net assets equaled their fair values on this date. Sunflower's net income and dividends for 2013 through 2015 were as follows:

-Assume that Pansy has significant influence and uses the equity method of accounting for its investment in Sunflower.The balance in the Investment in Sunflower account at December 31,2015 was

Definitions:

SOAP Documentation

An organized method of documentation in healthcare that includes four sections: Subjective, Objective, Assessment, and Plan.

Discharge Summary

A document that summarizes a patient's hospital stay, including the reason for admission, the care provided, treatment outcomes, and follow-up plans.

Follow-Up Care

Medical care and treatment that continues after the initial treatment or surgery, aimed at monitoring a patient's recovery or disease progression.

Patient Status

Information pertaining to a patient's current health condition or situation within a healthcare setting, including management plans and care updates.

Q4: If the partnership agreement provides a formula

Q8: Bonds Payable appeared in the December 31,

Q10: Which method of accounting will generally be

Q11: DeFunk Corporation is being liquidated under Chapter

Q16: A simple partnership liquidation requires<br>A) periodic payments

Q19: Interest payments on loans outstanding that do

Q22: On January 2, 2013, Slurg Corporation paid

Q31: Several years ago, Pilot International purchased 70%

Q32: Temporary Regulations have the same authoritative value

Q32: On January 2, 2013 Carolina Clothing issued