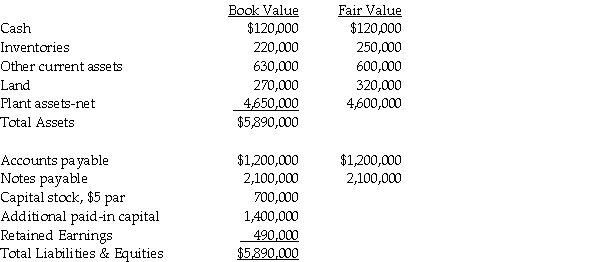

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31, 2013. Parrot borrowed $2,000,000 to complete this transaction, in addition to the $640,000 cash that they paid directly. The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below. In addition, Sparrow had a patent that had a fair value of $50,000.

Required:

Required:

1. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow survives as a separate legal entity.

2. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow will dissolve as a separate legal entity.

Definitions:

Merchandise sold cost

The total expense incurred to produce or purchase the goods that have been sold to customers.

Perpetual system

An inventory accounting system that records purchases and sales of inventory immediately through the use of technology, offering continuous stock level information.

LIFO

An inventory valuation method that assumes the last items placed in inventory are the first ones sold ("Last In, First Out").

Merchandise sold cost

The cost associated with the goods that have been sold to customers, typically accounting for the purchase or production cost of the merchandise.

Q6: Government-wide financial statements exclude the<br>A) general fund.<br>B)

Q12: The consolidated balance sheet of Pasker Corporation

Q12: Which method of accounting will generally be

Q18: Bart Company purchased a 30% interest in

Q19: Assume that Pansy has significant influence and

Q20: When a city enters into a capital

Q21: Pigeon Company owns 80% of the outstanding

Q25: On January 1, 2014, assume the fair

Q34: A pre-closing trial balance included the following

Q60: A Memorandum decision of the U.S. Tax