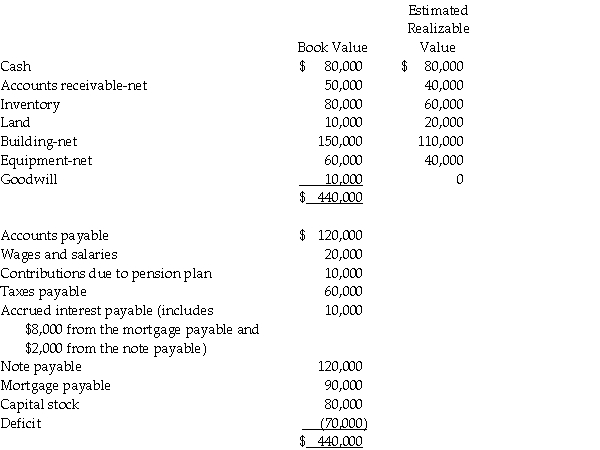

CommTex Corporation is liquidating under Chapter 7 of the Bankruptcy Act. The accounts of CommTex at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage. The note payable is secured with the equipment, but the interest on the note is unsecured. Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy; neither exceeds $4,000 per employee. Liquidation expenses are expected to be $40,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage. The note payable is secured with the equipment, but the interest on the note is unsecured. Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy; neither exceeds $4,000 per employee. Liquidation expenses are expected to be $40,000.

Required:

1. Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2. Devendor Corporation was a supplier to CommTex Corporation and at the time of CommTex's bankruptcy filing, Devendor's account receivable from CommTex was $25,000. On the basis of the estimates, how much can Devendor expect to receive?

Definitions:

Behavior Therapy

A type of psychotherapy that focuses on changing undesirable behaviors through conditioning techniques.

Social Psychology

The scientific study of how people's thoughts, feelings, and behaviors are influenced by the actual, imagined, or implied presence of others.

Group Therapy

A form of psychotherapy where a small group of patients meet regularly to talk, interact, and discuss problems with each other and the therapist.

Inferiority Feelings

Emotions arising from the conscious or unconscious perception of one's self as being less than others in some way, which may motivate compensatory behaviors.

Q9: When preparing consolidated financial statements, which of

Q24: At December 31, 2013, Pandora Incorporated issued

Q29: With respect to exchange rates, which of

Q30: Stilt Corporation purchased a 40% interest in

Q36: Which of the following assets and/or liabilities

Q36: Snow Company is a wholly owned subsidiary

Q94: Carolyn is single and has a college

Q134: Amy works as an auditor for a

Q158: When contributions are made to a Roth

Q166: Any pre-tax amount elected by an employee