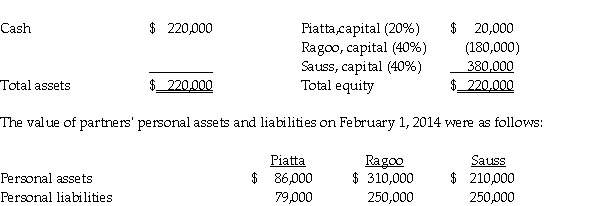

At the end of 2013, the partnership of Piatta, Ragoo, and Sauss was dissolved. By February 1, 2014, all assets had been converted into cash and all partnership liabilities were paid. The partnership balance sheet on February 1, 2014 (with partner residual profit and loss sharing percentages) was as follows:

Required:

Required:

Prepare the final statement of partnership liquidation.

Definitions:

Tolerance

The ability or willingness to tolerate the existence of opinions or behavior that one dislikes or disagrees with.

Accommodating

Showing willingness to adjust actions or decisions to take into account others' needs or preferences.

Withdrawing

The act of pulling back or removing oneself from a situation, engagement, or commitment.

Confronting

The act of facing or addressing problems, disagreements, or challenging situations directly.

Q7: Accounts representing an allowance for uncollectible accounts

Q11: After eliminating/adjusting entries are prepared, what was

Q16: Passcode Incorporated acquired 90% of Safe Systems

Q28: Rank the following claims of an

Q30: Pali Corporation exchanges 200,000 shares of newly

Q38: Under the Uniform Probate Code, the personal

Q81: The cost recovery basis for property converted

Q106: If a married taxpayer is an active

Q112: All listed property is subject to the

Q146: During the year, Peggy went from Nashville