Use the following information to answer the question(s) below.

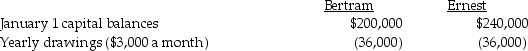

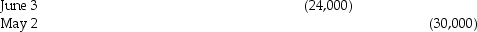

Bertram and Ernest share profits and losses equally after salary and interest allowances. Bertram and Ernest receive salary allowances of $40,000 and $60,000, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month, regardless of when additional capital contributions or permanent withdrawals are made subsequently within the month. Partners' drawings of $3,000 per month are not used in determining the average capital balances. Total net income for 2014 is $240,000. Permanent withdrawals of capital:

Permanent withdrawals of capital:

Additional investments of capital:

Additional investments of capital:

-If the average capital balances for Bertram and Ernest are $200,000 and $240,000,what will the total partnership profit allocations be for Bertram and Ernest in 2014?

Definitions:

Significant Problem

A major issue or difficulty that has a profound impact on a situation or individual's life, requiring attention or resolution.

Working Mothers

Women who maintain employment outside the home while also fulfilling maternal responsibilities.

Gender Role Stereotypes

Preconceived notions and expectations about behaviors, traits, and activities deemed appropriate for men and women based on their sex.

Flexible

Capable of being bent easily without breaking, and in a metaphorical sense, able to adapt quickly to change or new situations.

Q4: Cass Corporation's balance sheet at December 31,

Q6: With respect to goodwill, an impairment<br>A) will

Q11: A private, not-for-profit university received donations of

Q14: All personal property placed in service in

Q20: The modified accrual basis of accounting is

Q22: On June 1, 2014, Puell Company acquired

Q34: Pecan Incorporated acquired 80% of the voting

Q39: Prepare journal entries to record the following

Q110: An education expense deduction is not allowed

Q145: Tired of renting, Dr.Smith buys the academic