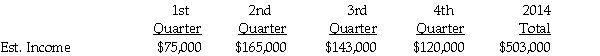

Nettle Corporation is preparing its first quarterly interim report. It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000. Its estimated pretax accounting income for 2014, by quarter, is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1. Determine Nettle's estimated effective tax rate for 2014.

2. Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Definitions:

Decision Making

The process of identifying and choosing alternatives based on the values, preferences, and beliefs of the decision-maker.

Consumers

Individuals or groups who purchase goods and services for personal use.

Employees

Individuals who work for a company or another person and receive compensation for their labor or services.

State

A politically organized body of people under a single government, often recognized as a sovereign entity.

Q2: On October 15, 2014, Napole Corporation, a

Q2: Shoreline Corporation had $3,000,000 of $10 par

Q7: On January 2, 2013 Palta Company issued

Q13: Discuss the difference between the half-year convention

Q21: Which of the following will be debited

Q22: The exchange rates between the Australian dollar

Q24: Assume Salter's net income for 2014 is

Q24: When the interest income of $50,000 is

Q27: What amount of Goodwill will be reported?<br>A)

Q48: Under the MACRS straight-line election for personalty,