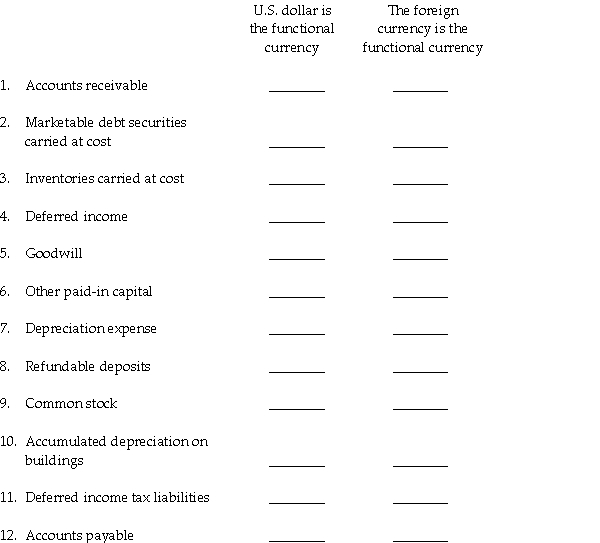

For each of the 12 accounts listed in the table below, select the correct exchange rate to use when either remeasuring or translating a foreign subsidiary for its U.S. parent company.

Codes

C = Current exchange rate

H = Historical exchange rate

A = Average exchange rate

Definitions:

Cost Per Unit

The complete cost associated with manufacturing, storing, and selling a single unit of a product or service.

Finished Goods

Inventory items that have completed the manufacturing process and are ready for sale to customers.

Variable Costing

A costing method that includes only variable costs—costs that change with production levels—in the calculation of unit costs.

Product Cost

The total expense involved in creating a product, including materials, labor, and overhead costs.

Q17: Under the current GAAP, Goodwill arising from

Q19: On December 31, 2013, Peris Company acquired

Q26: The accountant for Baxter Corporation has assigned

Q29: On January 2, 2014, Power Incorporated paid

Q35: Puddle Incorporated purchased an 80% interest in

Q40: Jefferson Company entered into a forward contract

Q42: In terms of IRS attitude, what do

Q48: Statutory employees:<br>A) Report their expenses on Schedule

Q82: A participant has an adjusted basis of

Q88: Last year, taxpayer had a $10,000 nonbusiness